iowa capital gains tax real estate

Select Popular Legal Forms Packages of Any Category. That equals 525000 profit.

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings.

. Use the following flowcharts to assist you in completing the applicable IA 100 forms and determining whether you have a qualifying Iowa capital gain deduction. Independently Verified Business CPAs Provide Reliable Business Tax Info Online. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

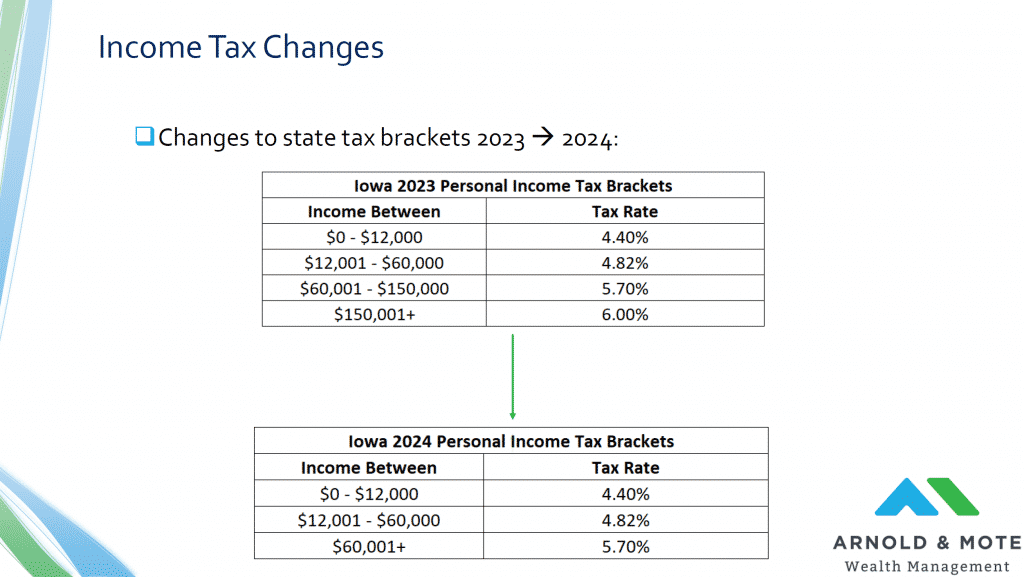

Capital gains are taxed as ordinary income in Iowa. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning. Capital Gains Tax on Sale of Property.

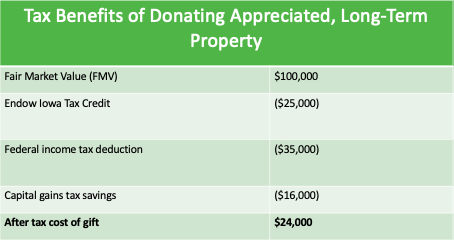

Iowas estate tax was repealed in 2008. Other Ways to Avoid Capital Gains Tax on Real Estate 1. Contact a Fidelity Advisor.

Raise Your Cost Basis by. Capital GAINS Tax Footer Toll Free 8773731031 Fax 8777797427 CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. What is the Iowa capital gains tax rate 2020 2021.

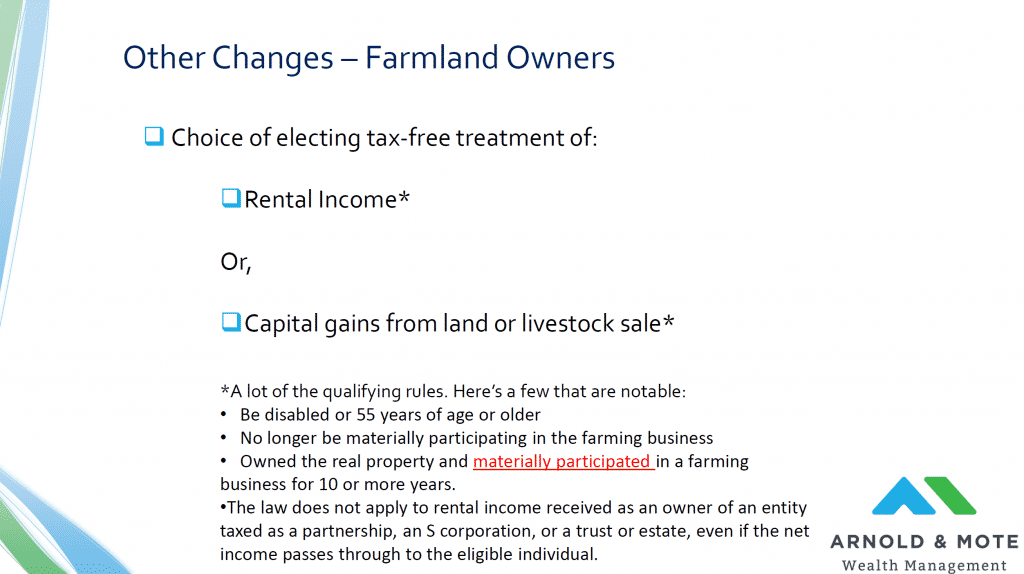

A Special Real Estate Exemption for Capital Gains Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home is exempt from taxation if you meet the. When you sell a stock you owe taxes on your gainthe difference between what you paid for the stock and what you sold it for. Iowa has a unique state tax break for a limited set of capital gains.

Capital assets are property used If youve sold property. What Is the Capital Gains Tax Rate on. 1031 Exchange Iowa - Capital Gains Tax Rate 2022 1031 Exchange Iowa Capital Gains Rates State Rate 853 Local Rate 022 Deduction None Combined Rate 3353 Additional State.

Live in the Property for 2 Years 2. All Major Categories Covered. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two.

Includes short and long-term Federal and. Contact a Fidelity Advisor. Get Tax Lein Info You Can Trust.

For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction. Check If You Qualify for Other Homeowner Exceptions 3. The same is true with selling a home or a second home but.

Iowa is a somewhat different story. If you sell the home you live in up to. Since the tax-free threshold for married couples is 500000 youll pay capital gains taxes on just 25000.

Taxes capital gains as income. The current capital gains tax of most investments is 0 15 or 20 of the profit depending on your overall income. Capital gains refer to the increase in the value of a capital asset between its purchase price and the price its sold at.

However the state has an inheritance tax that ranges from 1 to 15. Ad Ask Independently Verified Business Tax CPAs Online. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay. Taxes capital gains as income and the rate reaches 853.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. The rate reaches 715 at maximum. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. When a landowner dies the basis is automatically reset to the current fair.

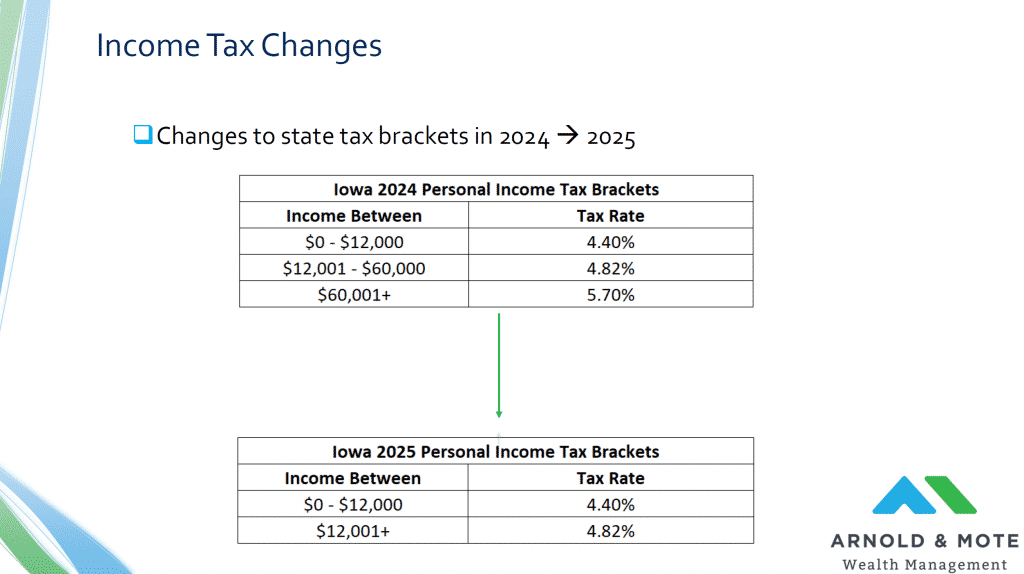

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Capital Gains Tax Iowa Landowner Options

Iowa Tax Rates Rankings Iowa State Taxes Tax Foundation

Final Four 4 Amazing Tax Breaks For Iowans On Charitable Gifts

Capital Gains Tax Iowa Landowner Options

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Cornering The Market Rental Income Advisors Rental Income Capital Gains Tax Rental

What Changes Are Coming To The Iowa Tax Landscape And When

Iowa Estate Tax Everything You Need To Know Smartasset

Capital Gains Tax Iowa Landowner Options

Capital Gains Tax Iowa Landowner Options

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Sale Tax Deductions

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map